A will is a document that is a statement of wishes. It provides direction for the distribution of your probate assets, appoints personal representatives and guardians, and allows you to specify other directions to carry out in connection with your estate upon your death. But, what happens when someone dies without a will in place? Or, the will that they previously drafted is deemed invalid? In that situation, that person has died “intestate” and the Massachusetts Intestate Statute, M.G.L. Ch. 190B, controls distribution.

Joint Ownership vs Individually Owned Property

When someone dies intestate, the first issue to analyze is how the decedent’s assets are titled. If the property was held in a trust, or if there was a will, the Mass Intestacy Laws will not apply. Further, in the case of a Revocable Living Trust, the property held in that trust would have the added benefit of avoiding the time and expense of probate. Likewise, if the decedent held any real estate as joint tenants with rights of survivorship, or as tenants by the entirety with a spouse, then the surviving joint owner(s) automatically receive the decedent’s interest in the property without a probate.

Life insurance policies, IRA accounts, 401(k) plans, retirement plans, bank accounts, and the like, often have named beneficiaries to receive the property upon death (noted as “Paid On Death” or “POD”). When an account has a named beneficiary, the account automatically passes to that named individual without additional intervention from the probate court. Similarly, if joint holders are on any bank accounts, the surviving owner will automatically have complete control upon the death of the joint owner.

For all other property and assets that the decedent owned individually, without a named beneficiary, a probate is required to transfer those assets. If there is no valid will, then the intestacy laws will direct distribution. Unfortunately, this often will not meet the objectives of the decedent. For example, this may not provide sufficiently for the surviving spouse and could direct some assets to other heirs.

Summary of the MA Intestate Statute

The following provides a summary of M.G.L. Chapter 190B which specifies the manner in which probate property will be distributed if there is no will.

The Surviving Spouse’s Share

The rights of all other heirs are subject to those of a surviving spouse under M.G.L Ch. 190B § 2-102. The probate court will always determine the surviving spouse’s interest first.

- Surviving Spouse Inherits Everything – The surviving spouse will typically be the main beneficiary of the intestate estate. In fact, the surviving spouse will receive the entire intestate estate, unless there is (1) a surviving descendant of the decedent who is not also a descendant of the surviving spouse, (2) a surviving parent, sibling, or next of kin, or (3) a descendant of either the decedent or the spouse from another relationship.

- Surviving Spouse and Parent with No Surviving Descendants – The surviving spouse will receive the first $200,000 and three-fourths of the balance of the intestate estate. The descendant’s parents would receive the remaining one-fourth.

- Surviving Spouse and No Parent with Siblings or Next of Kin – The surviving spouse will receive the first $100,000 and one-half of the intestate estate (if any). The decedent’s parents, siblings, or next of kin, would receive the remaining one-half under M.G.L. Ch. 190B § 2-103.

- Surviving Spouse and Surviving Descendants from Other Relationships – The surviving spouse will receive the first $100,000 and one-half of the balance of the intestate estate (if any), if you and the surviving spouse have a child, and the spouse has descendants from another relationship. Or, if you do not have any descendants with the spouse but do have descendants from a prior relationship. The decedent’s descendants will receive the other one half of the balance.

Distribution to Other Heirs

If there is a surviving spouse, then they receive their share first. Whatever remains of the intestate estate, then passes along to the remaining surviving heirs under M.G.L. Ch. 190B § 2-103 in the following order:

- First to the decedent’s descendants, if there are no surviving descendants;

- Then to the decedent’s parents, if there is no surviving descendant or parent;

- Then to the descendants of the decedent’s parents (in other words, the decedent’s siblings), if there is no surviving descendant, parent, or sibling;

- Then equally to the decedent’s next of kin in equal shares with those related by nearest ancestor;

- Finally, if there are no surviving kin, the intestate estate passes (“escheats”) to the Commonwealth of Massachusetts under M.G.L. Ch. 190B § 2-105:

Per Capita Distribution of Probate Estate

The distributions made under the intestate statute will be made according to a Per Capita formula. Per capita means “by head” and is the method by which descendants of a decedent receive a share of the intestate estate under the Massachusetts Statute. This means that each surviving heir will receive an equal share in the generation nearest to the decedent that has a member living at the decedent’s death. Whatever shares remain, are then combined and again divided equally among the descendants in the next generation nearest to the decedent.

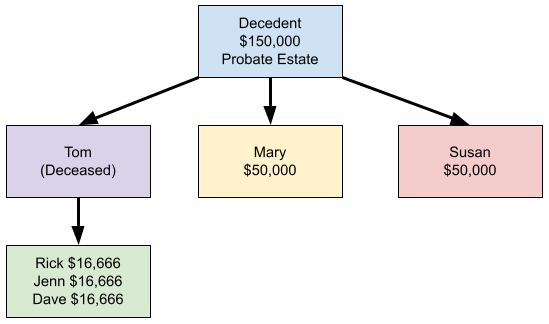

In the below examples, each of a decedent’s children would receive an equal share. If a child predeceases the decedent, then their children would receive what would have been their parent’s share. In the first flow chart, the first generation under the decedent has a living descendant (Mary & Susan). The $50,000 is therefore divided one-third at the level of the decedent’s children:

Tom’s one-third will be divided among his children Rick, Jenn, and Dave.

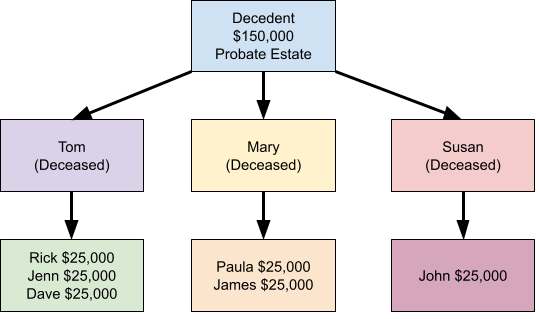

If all of the decedent’s children have died, the division occurs at the grandchildren’s level in equal shares. In the below, there are six grandchildren. The $150,000 will, therefore, be divided by six to determine the amount due to each grandchild ($25,000 each):

Next of Kin

Finally, when there is no spouse, descendants, or living parent, the property would pass to the decedent’s next of kin as defined under MPC 960. See the chart here on the mass.gov website for more information.

Conclusion

It becomes apparent that the above distribution scheme will not always work. For example, an individual’s parents could be independently wealthy. There might not be any need for them to inherit anything. Or, it could be that receiving anything could disqualify them from benefits that they presently receive. There could be unintended tax consequences as well. And, of course, the spouse could need all of the assets in the decedent’s estate to live comfortably. When the question is asked, why do I need a will, trust, or estate plan, there are many reasons, but of primary importance can be the application of the intestate statute which may have unintended consequences.

Proper estate planning is imperative to protect yourself and your loved ones. Contact our will and trust lawyers today if we can help you with your estate planning needs.